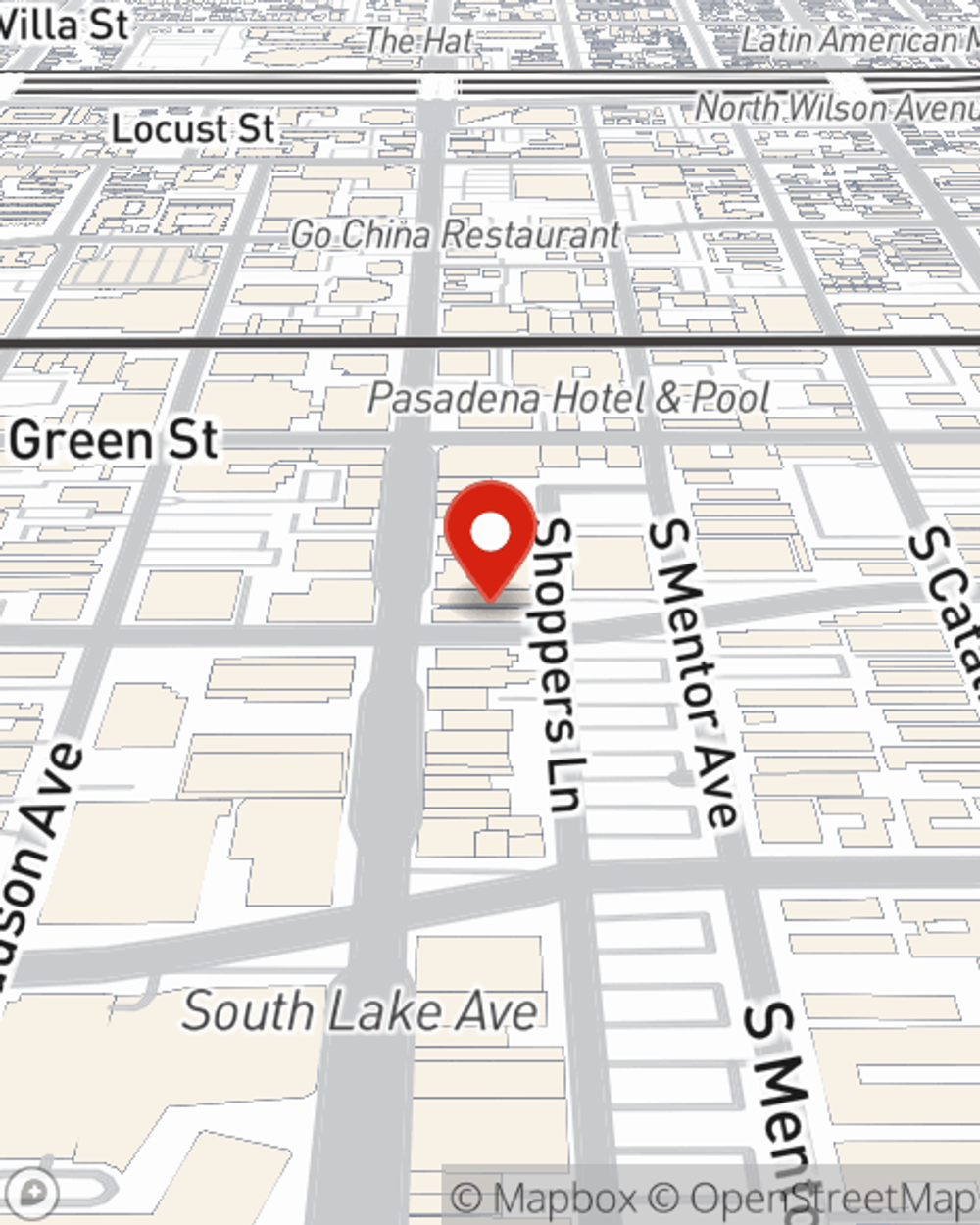

Life Insurance in and around Pasadena

State Farm can help insure you and your loved ones

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

- Pasadena

- Altadena

- Arcadia

- Monrovia

- Duarte

- Glendale

- La Canada/Flintridge

- Glendora

- La Verne

- San Dimas

- El Monte

- San Gabriel Valley

Protect Those You Love Most

Can you guess the price of a typical funeral? Most people aren't aware that the mean cost of a funeral nowadays is $8,500. That’s a heavy burden to carry when they are facing grief and pain. If the ones you leave behind cannot cover those costs, they may fall on hard times after your passing. With a life insurance policy from State Farm, your family can thrive, even without your income. Whether it pays for college, pays off debts or maintains a current standard of living, the life insurance you choose can be there when it’s needed most by your loved ones.

State Farm can help insure you and your loved ones

Now is the right time to think about life insurance

Life Insurance Options To Fit Your Needs

Fortunately, State Farm offers various coverage options that can be personalized to fit the needs of your loved ones and their unique situation. Agent John Diehl has the deep commitment and service you're looking for to help you opt for coverage which can help your loved ones in the wake of loss.

Interested in seeing what State Farm can do for you? Visit agent John Diehl today to get to know your personalized Life insurance options.

Have More Questions About Life Insurance?

Call John at (626) 791-9915 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.

Life insurance vs annuities

Life insurance vs annuities

Staying informed about how annuities and life insurance work makes it easier to come up with a financial roadmap that's tailored to your needs.

Simple Insights®

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.

Life insurance vs annuities

Life insurance vs annuities

Staying informed about how annuities and life insurance work makes it easier to come up with a financial roadmap that's tailored to your needs.